The problem of ‘externalities’ and ‘inclusivity’

The problem of ‘externalities’ and ‘inclusivity’

One of the reasons that economics as a science was doomed to failure was that the information, the figures involved in the maths, have been incomplete. For example, if trees are felled in a rain forest and shipped to the US for building materials, the costs are calculated as the costs of cutting down the trees, transporting and milling them into timber ready for sale.

What is left out of the maths is what economists call ‘externalities’. For example, the externalities of limber logging could include: the deforestation that causes the erosion of soil that runs into the river, that pollutes a valley and kills the fish stock 200 miles away and destroys the livelihood of a whole town that may be across a border in a completely different country. These very real repercussions are not included in the ‘costs’. They are ‘external’ to the calculation. It is estimated that if every major business had to pay for its environmental impact, then not a single one would be in ‘profit’, in the traditional sense of profit. Notice how we call it ‘environmental impact’ rather than a ‘capital cost’?

The United Nations, for example, may look at ‘growth’ rates across the world and calculate the growth of the country doing the logging, and the negative-growth of the town no longer able to fish, without making any connection because they have no way of calculating the figures.

The United Nations, for example, may look at ‘growth’ rates across the world and calculate the growth of the country doing the logging, and the negative-growth of the town no longer able to fish, without making any connection because they have no way of calculating the figures.

Recently the UN decided to add the costs of global warming to the price of extracting a barrel of crude oil from the ground. They calculated the costs of CO2 emissions at $20 a barrel. Firstly, this is a massive underestimation; $80 would apparently be a more realistic figure for the cost-effect of mining and burning the oil. But secondly, air pollution, water pollution, soil erosion, deforestation, animal extinctions, depletion of the environment and human suffering/starvation are nowhere in the calculation because the figures simply don’t exist.

So when the UN calculates growth rates of countries in GDP (gross national productivity) the figures are simply wrong. Almost every country in the world is in negative growth, in any meaningful terms.

So when the UN calculates growth rates of countries in GDP (gross national productivity) the figures are simply wrong. Almost every country in the world is in negative growth, in any meaningful terms.

So the very idea of ‘growth’, on which economics is based, is wrong.

Very recently we have started looking at the idea of ‘inclusive investment’, that is, the values of all capital, including human and natural capital, including the environment.

But, besides the fact that the calculations were wrong, economists did at least try to balance the books, like a good housewife. Economists and politicians believed in a healthy equilibrium of a nation’s imports and exports, in ‘balance of payments’.

At the beginning of the 20th century economists saw wealth as a ‘closed-system’, you could only take out what you put in. This all changed because of, yes – you guessed it – war.

The Gold Standard was flawed, the costs of the extraction of gold in Californian and Australian mines, and gold-hoarding in India, meant that the price of gold was variable. People started to argue that an ideal international ‘standard’ would be a paper standard, not gold at all.

In 1913, the British economist John Keynes came up with a radical idea (based on the idea of ‘chartalism’ – look that up in the alphabetical list on this site: Money Words and Ideas). He argued that banks could lend to entrepreneurs without borrowing the equivalent amount from ‘savers’. He argued that they not only could, but should do it. He believed that an injection of money into the system would boost the economy.

In 1913, the British economist John Keynes came up with a radical idea (based on the idea of ‘chartalism’ – look that up in the alphabetical list on this site: Money Words and Ideas). He argued that banks could lend to entrepreneurs without borrowing the equivalent amount from ‘savers’. He argued that they not only could, but should do it. He believed that an injection of money into the system would boost the economy.

Britain and the European ‘allies’ borrowed heavily from the US to fight the First World War (WW1). After the war, debt crisis and the ‘Great Depression’ of the 1930s led to unemployment rates in the UK of 15% and extreme hardship in Germany and Europe that arguably contributed directly to the rise of Hilter and to the Second World War (WW2).

One simple solution would have been debt cancellation like the ‘jubilees’ of ancient history. After WW1, John Keynes – by now a major player as advisor to the UK, Germany and the US – advised debt cancellation. But the US wouldn’t have it. There was a power-play going on between Britain and the US about who was going to control the world’s financial markets.

After WW1, various unsuccessful attempts were made to create a ‘European bloc’, a European trading group and a central European bank, or ‘clearing union’. Meanwhile, ‘restrictive practices’ (import taxes) were imposed on American goods.

After WW1, various unsuccessful attempts were made to create a ‘European bloc’, a European trading group and a central European bank, or ‘clearing union’. Meanwhile, ‘restrictive practices’ (import taxes) were imposed on American goods.

Eventually, in 1931, under the strain of war, debt and unemployment and the limiting factor of the amount of gold available, the Gold Standard – with its value linked to Pounds Sterling (the UK pound) – collapsed. The UK hoped that Sterling would become the new standard, but the US was ready to take its advantage. When America entered WW2 in 1941 it made its conditions very clear: We lend you money now, you lift import taxes – trade discrimination – against the US.

After WW2, in 1944, John Keynes again tried to negotiate a debt cancellation with the US but failed. America called in its debts. If the European Clearing Bank had actually happened, it could have helped the UK plug its ‘dollar-gap’ but as it was, Britain was bankrupt, and dependent on US ‘financial assistance’: a hefty loan, with interest, to pay for the war.

The US dollar became the new standard, with an exchange rate linked to the price of gold, until the gold-dollar standard too fell apart because of war debt. The US spent the 1960s waging war and went into huge deficit because of its expensive disaster in Vietnam, in particular. In 1971 the French President Pompidou sent a battleship to New York harbour and demanded $151 million of US debt in gold. American President Nixon simply left the Gold Standard and untied the fixed guaranteed rate of the dollar to gold. Now the major banks of the world could ‘print money’. That is, there was – and still remains – no limit to what they could ‘lend’.

The US dollar became the new standard, with an exchange rate linked to the price of gold, until the gold-dollar standard too fell apart because of war debt. The US spent the 1960s waging war and went into huge deficit because of its expensive disaster in Vietnam, in particular. In 1971 the French President Pompidou sent a battleship to New York harbour and demanded $151 million of US debt in gold. American President Nixon simply left the Gold Standard and untied the fixed guaranteed rate of the dollar to gold. Now the major banks of the world could ‘print money’. That is, there was – and still remains – no limit to what they could ‘lend’.

Money creation

Money creation

The idea that, as John Keynes said, banks could lend to entrepreneurs more than savers invested in the banks, now became normal practice. Yet it seems to have taken us all this time to realise that when a bank says it will lend us money, someone is simply clicking a button and creating debt. There is no money to lend. What is the ‘finance industry’? What does that even mean? ‘Industry’ implies work and that something is actually ‘produced’. As US and European production was systematically moved to factories in China and Asia where wages are lower, the west became less able to make money from its own production, and instead moved its attention to making profit from buying and selling debt.

In the 1970s western banks aggressively sold loans to dictators in the developing world, who either squandered the money, or carefully banked it for themselves. In the 1980s and 1990s, so called ‘third world’ countries tried to overturn these rulers and create democracy for themselves. Two things stopped them taking control of their own finances, the interest on the debt repayments, and the US military intervention that made sure they paid it.

In our distant past there were mechanisms to protect debtors from creditors, like the ‘jubilees’ or debt cancellations of the ancient Middle East, a settling-up when debt spiralled out of control. Now the IMF (International Monetary Fund) made sure that it was the other way around. When nations couldn’t pay, the loans were ‘re-financed’ but only if they agreed to ‘structural adjustment policies’, which meant austerity: privatising public assets, cutting public, or ‘welfare’, spending and imposing ‘free trade’ (this is the idea of so-called free market ‘competition’, whereby US goods manufactured by industries that have been subsidised by the US government, compete on price with goods from countries that are not allowed to subsidise their industries). It was now the creditors – the lenders – who received the protection.

The role of politicians

The role of politicians

Politicians promise to promote the interests of their own nation over and above any other. If the US, for example, is dependent on the income from its ‘finance industry’ and no longer has much of a manufacturing base of its own, it stands to reason that its politicians would prioritise repayments on its loans, over and above the interests of the third world countries and their needs.

This is an extract from ‘Policy Planning Study 23’, written by George Kennan for the US State Department in 1948, which was obviously classified at the time.

“We have about 50% of the world’s wealth but only 6.3% of its population…In this situation, we cannot fail to be the object of envy and resentment. Our real task in the coming period is to devise a pattern of relationships which will permit us to maintain this position of disparity…To do so we will have to dispense with all sentimentality and daydreaming; and our attention will have to be concentrated on our immediate national objectives… We should cease to talk about vague and…unreal objectives such as human rights, the raising of living standards, and democratization. The day is not far off when we are going to have to deal with straight power concepts. The less we are then hampered by idealistic slogans, the better.”

“We have about 50% of the world’s wealth but only 6.3% of its population…In this situation, we cannot fail to be the object of envy and resentment. Our real task in the coming period is to devise a pattern of relationships which will permit us to maintain this position of disparity…To do so we will have to dispense with all sentimentality and daydreaming; and our attention will have to be concentrated on our immediate national objectives… We should cease to talk about vague and…unreal objectives such as human rights, the raising of living standards, and democratization. The day is not far off when we are going to have to deal with straight power concepts. The less we are then hampered by idealistic slogans, the better.”

As for the USA’s relationship with the developing world, Kennan said that the role of the third world was to:

“ fulfil its major function as a source of raw materials and a market”

US planners saw the idea of a government being responsible for the welfare of its people as ‘communism’ and spent a lot of time, and energy, generating propaganda against this controversial word.

Noam Chomsky’s ‘How The World Works’ documents American post-war foreign policy, and it is not a comfortable read. He catalogues how millions of people died as the US sent military forces into countries to crush independence uprisings, under the excuse of overthrowing insurrection and communism. Or, more cleverly, funded local rulers to do it for them, with force and cruelty.

Noam Chomsky’s ‘How The World Works’ documents American post-war foreign policy, and it is not a comfortable read. He catalogues how millions of people died as the US sent military forces into countries to crush independence uprisings, under the excuse of overthrowing insurrection and communism. Or, more cleverly, funded local rulers to do it for them, with force and cruelty.

For example, Korea (1945), Greece (1947), Iran (1953), Dominican Republic (1963 and 1965), Brazil (1964), Vietnam (1955 – 1975), Indonesia (1965), Chile (1973), Philippines (1972), Nicaragua (1970s), El Salvador (1980), Panama (1989), Iraq (1991+ and 2003+) (Since the fall of the Berlin Wall the excuse has more recently been Islamic Fundamentalism, justifying western military activity in, for example, Afghanistan, Syria, Palestine and the West Bank).

For example, Korea (1945), Greece (1947), Iran (1953), Dominican Republic (1963 and 1965), Brazil (1964), Vietnam (1955 – 1975), Indonesia (1965), Chile (1973), Philippines (1972), Nicaragua (1970s), El Salvador (1980), Panama (1989), Iraq (1991+ and 2003+) (Since the fall of the Berlin Wall the excuse has more recently been Islamic Fundamentalism, justifying western military activity in, for example, Afghanistan, Syria, Palestine and the West Bank).

Chomsky goes so far as to say

“I think, legally speaking, there’s a very solid case for impeaching every American president since the Second World War. They’ve all been either outright war criminals or involved in serious war crimes.”

There are not many people who still believe that Western intervention in foreign countries is about idealistic principles. It is increasingly obvious to most of us that it is about a power grab for natural capital, raw materials, oil and the interest payments on debt.

In 2002 the economy of Argentina crashed in what has been called the greatest default in history. The International Monetary Fund (IMF) was powerless as Brazil and Nigeria followed. The IMF has had a return to importance managing austerity in Europe following the emergency in the Greek economy in 2008 when Greece pleaded with the European Union to allow it to leave the Euro – the latest European ‘standard’ – and cancel its debt. That hasn’t gone so well, so far. But Yanis Varoufakis, the Greek finance minister who proposed this ‘radical’ idea, is no small-player. He was for many years a Professor of Economics in Britain, Australia and the USA.

In 2002 the economy of Argentina crashed in what has been called the greatest default in history. The International Monetary Fund (IMF) was powerless as Brazil and Nigeria followed. The IMF has had a return to importance managing austerity in Europe following the emergency in the Greek economy in 2008 when Greece pleaded with the European Union to allow it to leave the Euro – the latest European ‘standard’ – and cancel its debt. That hasn’t gone so well, so far. But Yanis Varoufakis, the Greek finance minister who proposed this ‘radical’ idea, is no small-player. He was for many years a Professor of Economics in Britain, Australia and the USA.

The activities of the USA since WW2 could be seen as immoral and unethical, but are they any worse than the colonial behaviour of the Conquistadores, the English and Dutch East India Companies and British colonial activity in Africa, India, Bengal, China, South East Asia, North America and Australia in the 18th and 19th centuries? One way or another, colonialism is still alive and accountable.

Why is inequality important?

Why is inequality important?

There is extreme inequality between countries in different parts of the world, between rich and poor within the same country, between black and white, women and men, and a ‘generational inequality’ whereby our grandchildren will have less than us, if we don’t stop consuming all their natural capital.

Inequality leads to exploitation. If you need money to make money, some people can invest and earn ‘interest’ on ‘unearned income’, whilst others toil for less than a dollar a day.

If you have ‘ownership’ of natural capital (for example ‘owning’ land) you can dictate the terms, determining how others put food on their table. When we all had access to the same natural or common capital, we could all feed ourselves, to a greater or lesser extent, and would live or die depending on how well we cooperated, or shared, with each other.

Some studies have looked at GNH (gross national happiness) instead of GNP (gross national productivity) and found that people are as happy when they are similarly poor as when they are similarly rich. That is, people who live in societies where the richest are no more than 20 times richer than the poorest are happiest, whether that’s in rich countries (the Netherlands) or poor (Bhutan). 20 times richer than me sounds like extreme wealth but in large corporations the top earners typically earn more than 300 times the lowest paid. We are recently learning about the 1%. Eight families in the world hold 70% of the world’s wealth. How did that even happen? Because of inheritance.

I nheritance

nheritance

The economist Thomas Picketty has looked at inheritance and the myth of ‘trickledown’ wealth and found that in a capitalist system the rich get richer and the poor stay poor.

We used to think that when an economy ‘grows’ everyone gets richer and by definition the inequality gap gets less. If you favour entrepreneurs (with tax cuts etc.,) then they will be able to make money and employ people who will get richer too.

Picketty found that this is not true. That is because of the way financial ‘markets’ work, where you ‘earn’ more in interest from investments in money itself, than from so-called economic ‘growth.’ Instead of employing people, rich people invest money for their children. Families with large wealth have been able to become families with massive wealth, who pay little or no tax, so their wealth is not ‘shared’ at all. Where money is concentrated, it grows faster. In other words it trickles up, not down, so that, over generations, we have arrived at a situation which we call the One-Percent (1%). One percent of the world’s population controls over 90% of its wealth. Picketty suggests taxing capital investments, and that it would have to be done in a way that crossed international borders, as this is how the mega-rich avoid paying tax, moving their money between ‘shell’ companies in different countries. A global cooperation on tax avoidance would be difficult, but Picketty suggests it might be possible within Europe. He suggests 1% tax on capital wealth over E1M, 2% on wealth between E5M – E10M etc. Some people have cynically – but perhaps logically – suggested that this is the real reason that the 1% in the UK want to leave Europe.

Entitlement

Entitlement

We are randomly born into rich or poor countries, or rich or poor families, not through any superior or inferior genes, but through simple luck of geography and history. We have seen the reasons why northern europe gained material advantage over other parts of the world and it is clear that some people are just born in the ‘right place at the right time’ to have been able to have had the opportunity to have an advantage over others. People who want to keep this advantage have suggested moral arguments to justify it, for example a ‘work ethic’ that suggests that people who work hard get rich on their own merit, when it is clear that people will find it nearly impossible to improve their ‘standard of living’ if the odds are stacked impossibly against them.

If it were true that the hardest working were the most wealthy, then sub-saharan women would be the wealthiest people in the world.

The psychology of ‘entitlement’ is very interesting. Yanis Varoufakis in his book Talking to My Daughter About the Economy, says:

On the one hand, you were appalled by the idea that some kids cry themselves to sleep because they are hungry. On the other, you were thoroughly convinced (like all children) that your toys, your clothes and your house were rightfully yours. Our minds automatically equate ‘I have X’ with ‘I deserve X’.

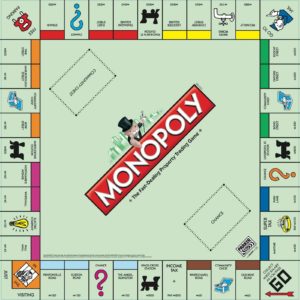

Berkeley University in the US did a very interesting experiment with a rigged version of the popular game Monopoly. They told a group of students that they were going to play Monopoly, but that some participants were going to have the game biased in their favour. They said ‘When you pass go you’ll get $400 while others will only get $200. When they land on your property you’ll get double what they’ll get for you landing on theirs.’ And then they observed the behaviour.

The unfairly advantaged university students were observed quickly believing that they ‘deserved’ to be winning. There was candy on the table. The disadvantaged participants asked politely if they may have some. The advantaged participants grabbed across the table and helped themselves. Within a very few moves the advantaged began to display behaviour that demonstrated that they believed they were winning because of their own merit, even though they had been told in advance that they would win only because the game was rigged. The experiment showed that, for some psychological reason, if you receive advantage, you believe you are entitled to it. This type of behaviour is intriguing and undoubtedly something to do with human evolution. Robert Trivers explains it in some depth in his Deceit and Self Deception – How to fool yourself the better to fool others. He also said ‘Don’t mistake economics for a science. Even if it acts like one, and quacks like one.’ The Berkeley experiment has been repeated many times over, with the same findings.

The unfairly advantaged university students were observed quickly believing that they ‘deserved’ to be winning. There was candy on the table. The disadvantaged participants asked politely if they may have some. The advantaged participants grabbed across the table and helped themselves. Within a very few moves the advantaged began to display behaviour that demonstrated that they believed they were winning because of their own merit, even though they had been told in advance that they would win only because the game was rigged. The experiment showed that, for some psychological reason, if you receive advantage, you believe you are entitled to it. This type of behaviour is intriguing and undoubtedly something to do with human evolution. Robert Trivers explains it in some depth in his Deceit and Self Deception – How to fool yourself the better to fool others. He also said ‘Don’t mistake economics for a science. Even if it acts like one, and quacks like one.’ The Berkeley experiment has been repeated many times over, with the same findings.

Margaret Thatcher (Prime Minister of the UK, 1979 to 1990) said ‘The problem with socialism is that you eventually run out of other people’s money’. She was part of the mindset of a certain place and time, in our history, that believed absolutely that those who had the money, in that moment in time, deserved to keep it. (She also said ‘There’s no such thing as Society’). Now we know better. We understand that the foundation of our wealth is the natural resource of the planet and it is time we looked for a better way to share it around.

What will happen if we don’t change?

What will happen if we don’t change?

Up until the 1970s interest rates were capped at 10%. Removing this top rate at which interest could be charged, in the early 21st century, led to short term ‘pay-day’ loans of over 2,000%. In Britain, in the late 20th century, mortgage-lenders were prepared to lend two-and-a-half times household income towards the cost of buying a house. In the 1960s and 1970s young teachers and factory workers could buy a house. How many of us have the kind of salary that you need to buy a house at today’s prices, even though banks will now lend four or five times your salary?

Much as land became a commodity during the Agricultural Revolution after ‘enclosure’, homes have also become commodities, to be bought and sold for profit. What some would consider to be basic human rights, to food and shelter, to others have become means to make profit. The food giant Nestle has ‘bought’ water ‘rights’ to extract, bottle and sell water. How did they get those rights and what happens to the people whose water has effectively been stolen, if they can’t afford to ‘buy’ their own water.

It is tempting to see money like The Emperor’s New Clothes. Everyone knows he’s really naked, and the clothes don’t exist. But the entire kingdom is based on the idea of the magnificent robes, the instruments of government are founded on them and nobody wants to see it all collapse into chaos, better keep up the myth of the clothes.

But we now know that it will collapse. How can anyone buy a house that is 15 times their annual salary, without an inheritance? Or pay £2,000 to borrow £1?

But we now know that it will collapse. How can anyone buy a house that is 15 times their annual salary, without an inheritance? Or pay £2,000 to borrow £1?

Keynes and his generation decided it was a good idea for governments to ‘create’ money and inject it into the economy to promote ‘growth’ in the early 20th century, abandoning the idea of binding the economy to a fixed standard, like gold. Since so-called ‘Thatcherism’ in the 1980s and the ‘deregulation’ of the finance industry, capitalism has been able to run away with itself. It no longer has much to do with producing goods. Profit is made from buying and selling currency, buying and selling debt, and stealing and selling natural resources.

What are we thinking? What will happen when those third world countries simply can’t pay their debt repayments anymore? Homeowners can’t pay their mortgages? It is already happening. People are starting to say that capitalism is eating its own tail, it has spiralled out of control and will soon become the means to its own destruction. That it is not real. The Emperor is not wearing any clothes.

What are we thinking? What will happen when those third world countries simply can’t pay their debt repayments anymore? Homeowners can’t pay their mortgages? It is already happening. People are starting to say that capitalism is eating its own tail, it has spiralled out of control and will soon become the means to its own destruction. That it is not real. The Emperor is not wearing any clothes.

Next: How To Fix It